The First Timer’s Guide to Novated Leasing for Private Employees and Employers

Getting your head around car leasing for the first time can feel a bit overwhelming—there are plenty of options, and the jargon doesn’t always make things easy. If you’re an employee or employer new to novated leasing, you might be wondering where to start and how it all works. That’s exactly why we’ve put together this first-timer’s guide to novated leasing. We’ll walk you through the essentials—how it works, the key benefits, and what to consider—whether you’re looking to save on car costs or enhance employee benefits.

No complicated terms, just clear and simple info to help you make the right choice. Whether you’re exploring new ways to get behind the wheel or looking for smart workplace perks, this guide will break it all down for you. Stick with us to see how novated leasing can be a game-changer for both your lifestyle and work.

What’s Inside:

- Australia: The Home of Novated Lease Expertise

- Novated Leasing for Private Employees and Employers

- The First Timer’s Guide to Novated Leasing

- Let’s Make Novated Leasing Work for You

Australia: The Home of Novated Lease Expertise

When it comes to novated leasing, Australians are truly leading the way. The country has become a hub for novated lease expertise, and it is no surprise why. Australians have embraced this flexible leasing option, making it one of the most popular ways to drive brand-new cars, including electric vehicles (EVs).

In fact, novated leasing is playing an important role in the rise of EVs in Australia. According to the latest data from the National Automotive Leasing and Salary Packaging Association (NALSPA), EVs made up 35-40% of all new novated leases in the first few months of this year. This impressive uptake is a clear indication that Australians know how to make the most of novated leasing.

Source: driven.io

Novated Leasing for Private Employees and Employers

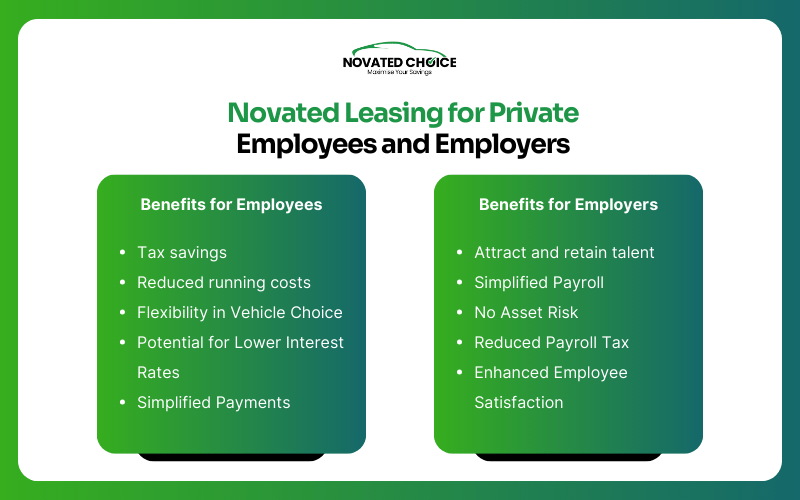

Novated leasing is a car finance arrangement involving three parties: the employee, the employer, and the finance provider. Let’s explore how novated leasing benefits both employers and employees, making it a smart choice for your business and lifestyle:

Benefits for Employees

Tax Savings

One of the standout benefits of novated leasing is the potential tax savings. Because lease payments are deducted from your pre-tax salary, you can reduce your taxable income, meaning you may pay less tax.

Reduced Running Costs

A novated lease typically covers more than just the car's purchase price. Knowing exactly what your vehicle expenses will be each month can simplify budgeting and help you avoid unexpected costs.

Flexibility in Vehicle Choice

You can choose the car that suits your needs and lifestyle. When the lease term ends, you can lease another vehicle, continue leasing the same car, buy the car, or walk away without further obligation.

Potential for Lower Interest Rates

Since novated leases are tied to employment, they often come with lower interest rates than personal car loans. This can help you save on the overall cost of the car.

Simplified Payments

With your employer handling the lease repayments through salary sacrifice, you don’t have to worry about separate payments. It’s all taken care of before you even see your income, making it a seamless and convenient process.

Benefits for Employers

Attract and Retain Talent

Offering the novated lease for electric vehicles can be a great employee perk. It’s a highly desirable benefit to make your organisation stand out to potential hires.

Simplified Payroll

With a novated lease, the vehicle and lease payments are handled as part of salary sacrifice. This can streamline payroll processes and reduce administrative burdens.

No Asset Risk

Unlike providing a company car, where your business is responsible for the vehicle’s depreciation, with novated leasing, the employee takes on the asset risk.

Reduced Payroll Tax

Salary sacrifice arrangements, like novated leasing, may reduce your payroll tax liability, depending on the structure of the salary packaging and the state of operation.

Enhanced Employee Satisfaction

A structured program allows employees to enjoy significant financial benefits without additional cost to you.

The First Timer’s Guide to Novated Leasing

Ready to dive into novated leasing? Here are the steps you need to follow, even if you are an employee looking to lease a vehicle or an employer facilitating the process:

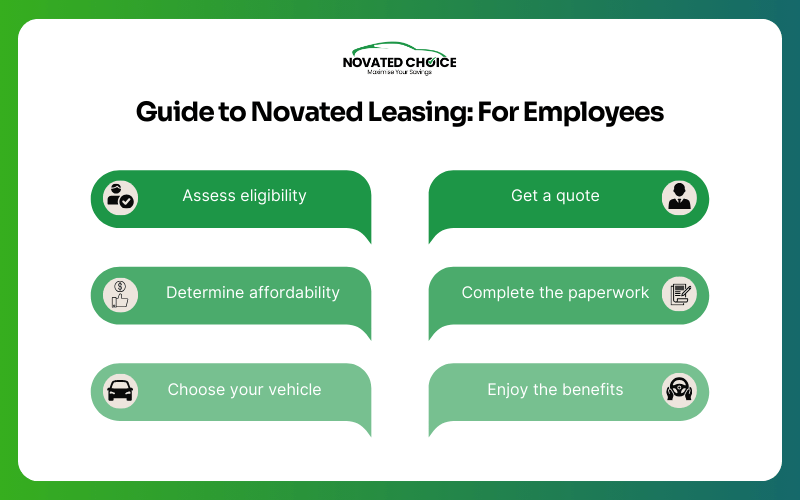

Guide to Novated Leasing: For Employees

1. Assess eligibility

Confirm that your employer offers novated leasing as part of their benefits package. Ensure you meet any specific eligibility criteria set by your employer or the leasing company.

2. Determine affordability

Evaluate your financial situation to ensure you can afford the lease payments along with other associated costs like insurance, maintenance, and fuel. Use a novated lease calculator to estimate potential savings.

3. Choose your vehicle

Once your employer has confirmed the novated lease is an option, it’s time to select a vehicle. The vehicle you choose must meet the finance provider’s requirements, so it’s best to do this through the employer's approved supplier or leasing company.

4. Get a quote

Novated Choice will provide a quote that includes details such as the term of the lease, the monthly payment, running costs, and overall savings. You can decide whether you want to include these running costs in your lease or pay them separately.

5. Complete the paperwork

After you’ve chosen your vehicle and finalised the costs, the next step is to sign the novated lease agreement. This includes agreeing to a salary sacrifice arrangement where a portion of your salary will go towards making the lease payments.

6. Enjoy the benefits

As you drive your new vehicle, you will enjoy the financial perks of having the lease payments deducted from your salary before tax, reducing your taxable income, and potentially lowering your overall tax bill.

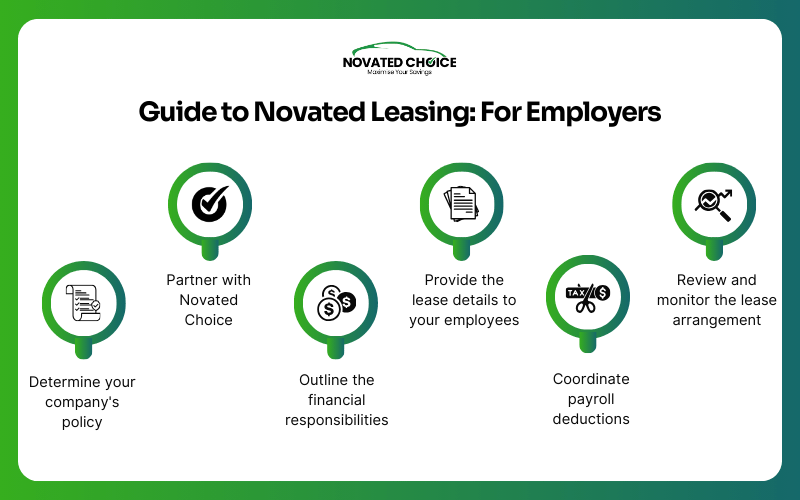

Guide to Novated Leasing: For Employers

1. Determine your company's policy

If you are considering offering novated leasing as a benefit, first establish clear policies and procedures. FBT exemption will not impact the employer, however, full FBT on non-electric vehicles potentially can.

2. Partner with Novated Choice

Novated Choice can help structure the lease, manage paperwork, and ensure compliance with relevant tax laws.

3. Outline the financial responsibilities

As the employer, you will need to manage the salary packaging arrangement. Your leasing provider will provide clear instructions on how to set up an employee deductions correctly, ensuring there is no FBT liability outstanding

4. Provide the lease details to your employees

Once the logistics are sorted, communicate the benefits and options to your employees. Explain how the novated lease works, the benefits of salary sacrificing, and what they need to do to set up their lease.

5. Coordinate payroll deductions

After an employee has chosen their vehicle and signed the agreement, you will need to adjust their payroll deductions.

6. Review and monitor the lease arrangement

It is important to regularly review the novated lease arrangements to ensure everything is being handled correctly. This includes confirming that deductions are accurate and ensuring no FBT implications arise.

Let’s Make Novated Leasing Work for You

You have now explored our Guide to Novated Leasing, and you are probably wondering how this option can fit into your personal or business financial strategy. By partnering with the right experts, you can maximise the potential of novated leasing and streamline the process for everyone involved.

For more information or to discuss how novated leasing can benefit your specific situation, don't hesitate to reach out to us. Novated Choice is ready to provide you with tailored advice, help you understand your options, and guide you through each stage. Contact us today and let’s make the next step easier for you.